5 Reasons Why Boomers Are Still on Top.

People from 55 to 75 are often overlooked and even discriminated against According to AARP, only 5% of ad dollars target this demographic. That’s just plain silly since this population accounts for nearly 50% of all spending!

Boomers needs and wants as consumers – and as people – are quite different. But pay attention or miss out. These folks DO pay attention to any slights against them, then they respond – with their credit cards and wire transfers.

5 Reasons Why Baby Boomers Still Relevant

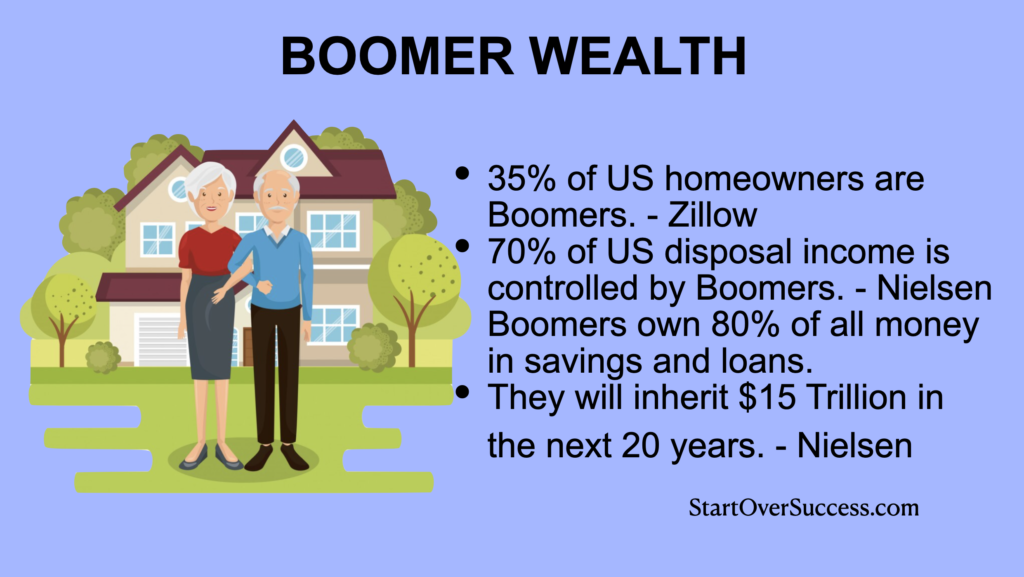

1. Baby Boomers Hold the Majority of the Wealth

The Baby Boomers currently hold the majority of the nation’s wealth. This is due to the favorable economic times they experienced during their wealth-building years.

The economic growth and favorable economy and policies at that time meant Baby Boomers had an easier time earning and accumulating wealth than any other generation before them – or since.

In their time, home prices and interest rates were reasonable. All this resulted in them having a larger share of total household financial assets than any other age group.

Plus, their financial stability made it possible for them to ride out recessions and market downturns with relative ease.

On the other hand, current market and world conditions present challenges for younger generations.

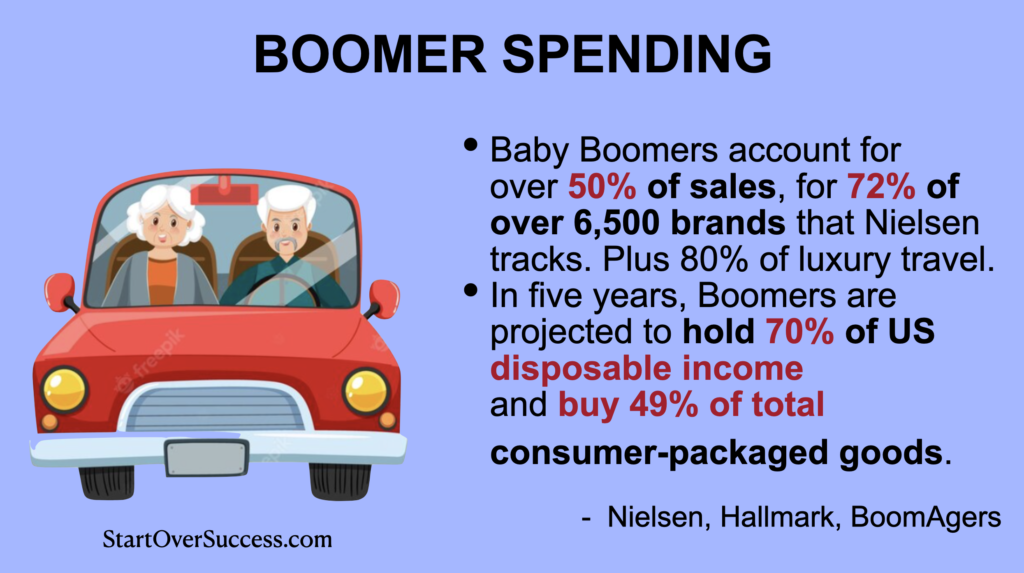

2. Baby Boomer Spending Power

Not only do they spend more than other generations but they also help their kids out with their debts. According to a survey conducted by the Consumer Financial Protection Bureau (CFPB), 37% of millennials live with their parents which means that baby boomers often help out with their children’s debt repayment.

Baby boomers are able to do this because of the abundance of money they have saved over time due, to their high disposable income, and investing habits. This has caused them to become some of the biggest spenders in the US today.

Baby boomers have entered or are close to their retirement years and possess greater disposable income than ever before. As such, they are spending more than their younger counterparts on a variety of items and services. In fact, a recent survey revealed that baby boomers contributor to 50% of all spending.

Moreover, the same survey showed that baby boomers are also more likely to help their children with debt payments, with 37% of kids in this generation living with their parents in order to reduce the cost of living. All these figures demonstrate how much more money baby boomers have compared to other generations, resulting in them being able to spend considerably more on discretionary items.

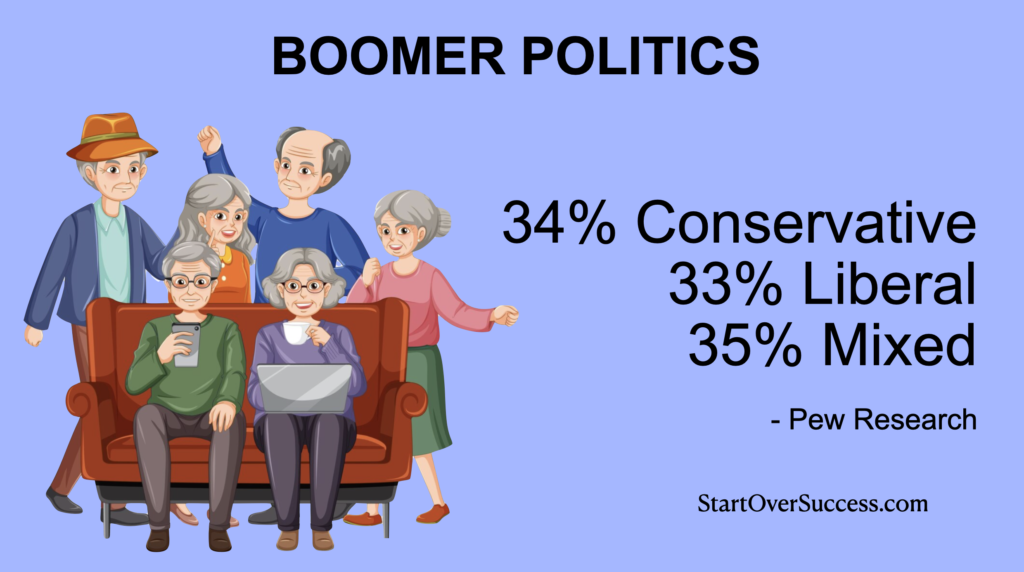

3. Boomers are the Second-Largest Demographic. And They Vote

Baby Boomers are the second largest demographic, with 21.16% of the US population. While millennials are a bit more than that, at 21.75% as of 2021.

The Boomer population is rapidly aging and yet they remain politically active and engaged. In 2018 elections, Boomers and previous generations voted 60.1% of the time, while Gen X, Millenial, and Gen Z combined voted 62.2% of the time.

While sensitive to the needs of upcoming generations, they are also likely to vote on issues that favor themselves. It is important that politicians consider the needs of this group when deciding on policies. Politicians must be aware of the unique needs of Baby Boomers and work to create solutions that will meet their needs while still addressing the needs of other generations.

4. Baby Boomers are More Active & Healthier.

More active and healthy? Well, they want to be. But that doesn’t square with what’s really going on. Baby Boomers are on the go, going shopping, dining out, visiting family and friends, and traveling. (They account for 80% of all luxury travel from US.) But, are they also exercising more and eating more nutrient-rich diets than previous generations did? Yes and no. They over-estimate how much exercise they do and under-estimate how many empty calories they eat.

The personal technology boom means seniors are sitting at their screens, where they can get entertainment, connection with others, news, and more – without leaving the sofa.

With improved medicine and pharma, people are living longer.

Boomers don’t just want longer lives, they want more purpose and enjoyment in their days.

Many of these young-at-heart folks report feeling as if they are 10 or 20 years younger than they actually are.

Instead of taking to a rocking chair, 65% of boomers walk or ride bicycles regularly. Or both. They are pushing harder because they can and they are highly motivated to do so. Or are they? According to a study by Medicine & Science in Sports & Exercise (MSSE), only 35% of the over-55 set do.

While younger people are fretting over their looks and keeping up with the Jones’s, Boomers are making the best of what they’ve got, downsizing and focusing on relationships. That serenity adds to their feeling of well-being.

That being said, while Boomers may have mounting health issues, they often push to make the most of the energy and flexibility they do have.

5. Boomers Transferring Wealth & Making Big Decisions

Boomer wealth isn’t represented exclusively by real estate and stock holdings. Boomers own 50% of all small businesses in the US.

As they retire and plan for transfers of wealth, they have much to consider.

While Boomers grew and managed to grow businesses to millions in earnings and worth, many of those businesses are boring, or just not, I gotta say it, they’re not sexy.

The sons, daughters, and even grandchildren may not be interested in carrying on with the family business. So many of those businesses just evaporate. But all of that value and potential that still exists in the businesses don’t have to simply evaporate.

For the savvy, this transfer of wealth, including that held in businesses the heirs don’t want to bother with, is a huge opportunity.

This is called the biggest transfer of wealth in history. Get on the right side of it. Baby Boomers who generated wealth have big decisions to make now. If they don’t yet have a succession plan in place, it’s time to consider your options and the ramifications of each decision. If they haven’t worked to build a favorable tax situation for all involved, again, it’s time.

Baby Boomers and Start-Over Success

For Baby Boomers who, for whatever reason find themself without wealth to pass on, I say, yet; they haven’t got that yet.

Some are still looking for more income. That’s okay.

There is still time and there are options. With Start Over Success’s business ideas starting at just $500 to get going, you see there are many ways to – still or again – build income and grow it to millions.

In addition, there are businesses ready for sale (before they simply evaporate) and for the right person to purchase. Maybe that person is you.